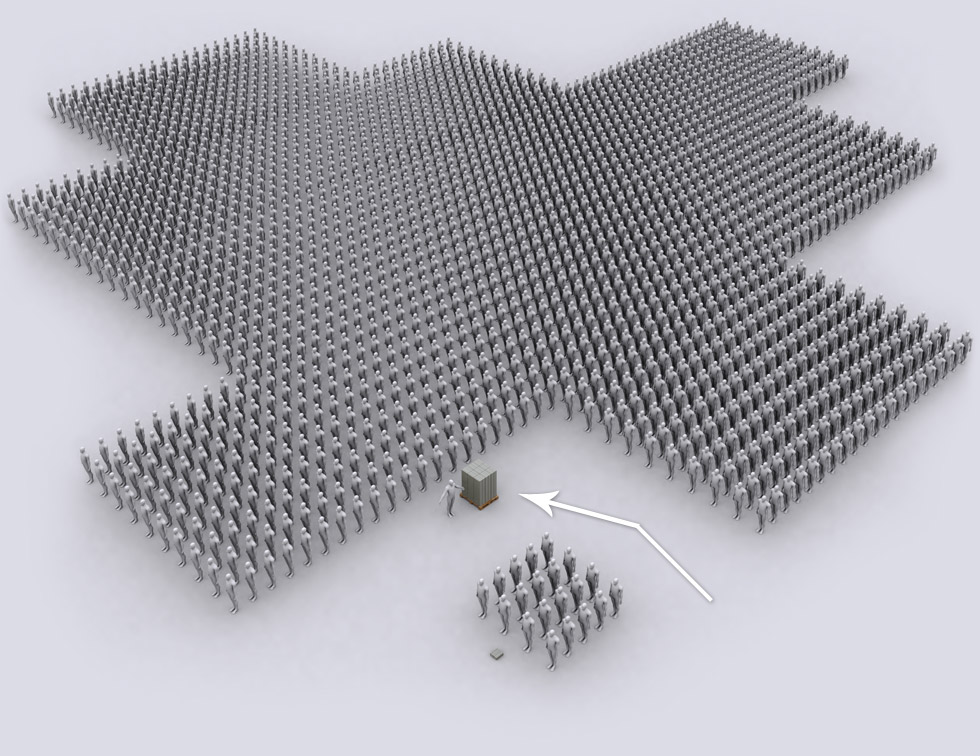

FDIC insures 7,181 financial institutions. The FDIC is funded by financial institutions that pay for deposit insurance coverage.

During the 1980's/1990's savings and loan crisis, a parallel insurer- the FSLIC (Federal Savings and Loan Insurance Corporation) went bankrupt.

The FSLIC replacement named RTC was merged into the FDIC. The savings and loan crisis cost tax payers $150 Billion.

The FDIC takes control of failed banks and financial institutions, where it first moves to find a buyer of all

the bank's assets, including the toxic ones. After the sale of assets (including toxic, usually at discounted

prices) the FDIC attempts to cover losses. The FDIC will first pay-out all insured accounts, followed by

applying “hair-cuts” to uninsured deposits. Safe deposit boxes, bond holders, stocks, money funds, etc. are

not insured by FDIC.

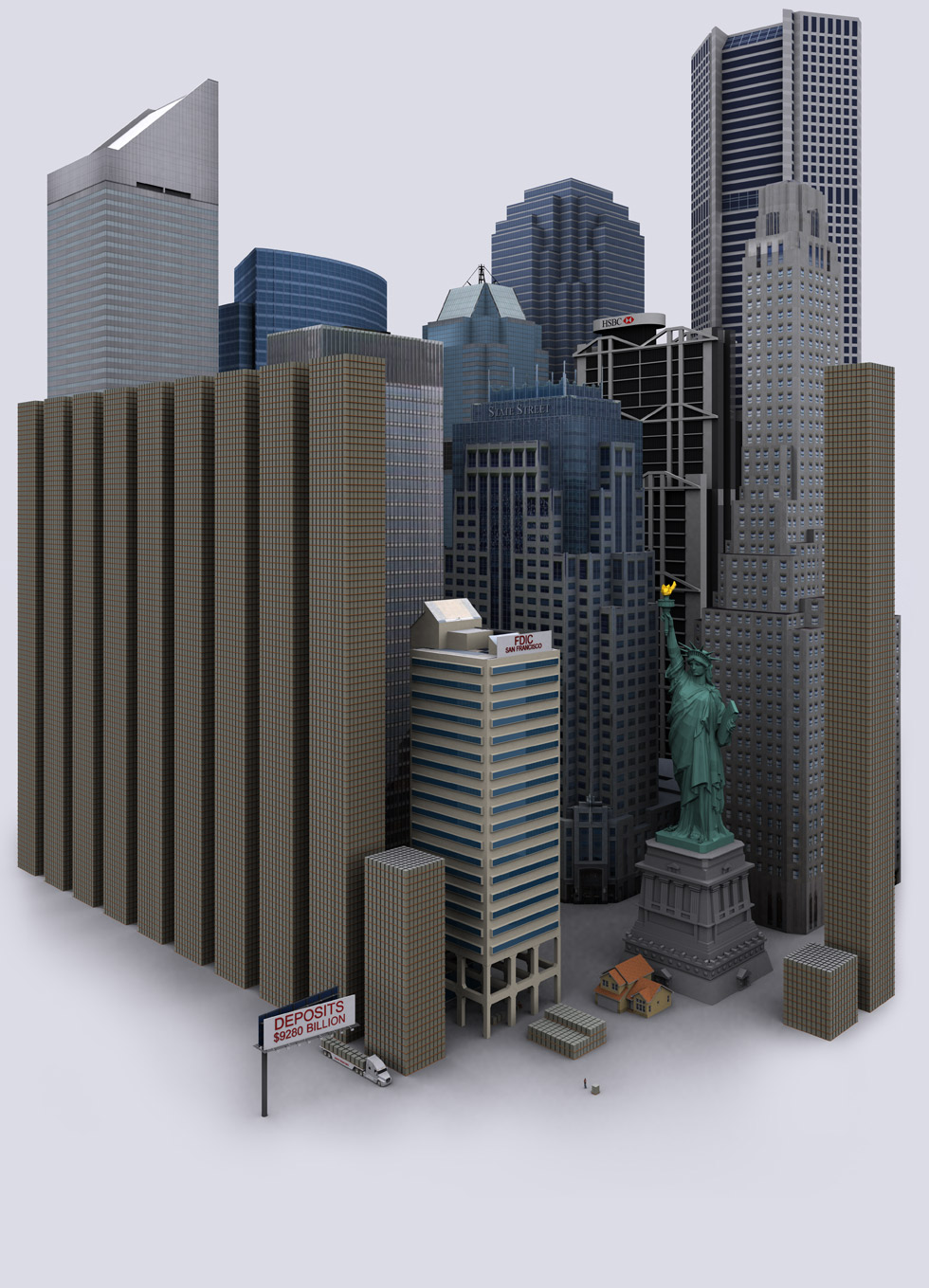

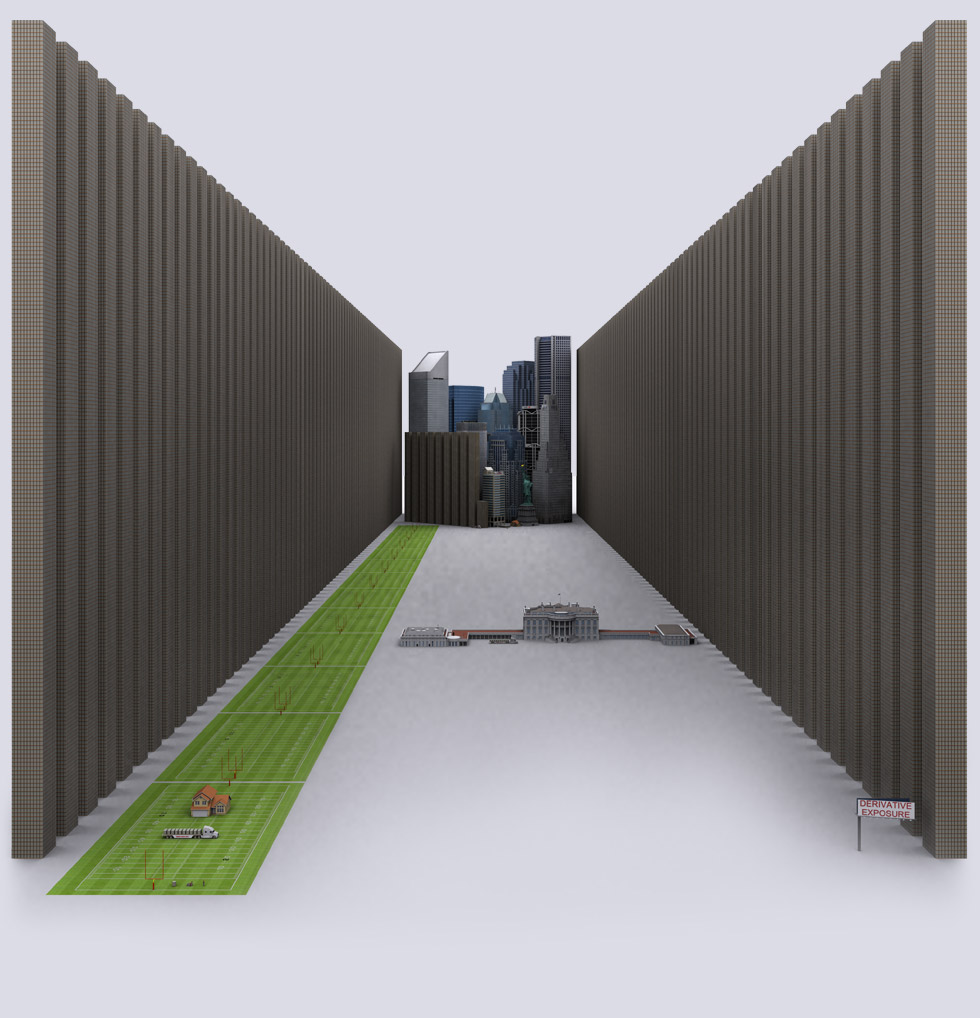

Due to bank failures during the 2008/2009 bank crisis, the FDIC fund fell to $0.648 billion by August of

2009. Subsequent bank failures almost bankrupted the FDIC, so it demanded a 3 year pre-payment from

banks to shore up its capital.

Wikipedia - "According to the FDIC.gov website (as of March 2013), 'FDIC deposit insurance is backed

by the full faith and credit of the United States government.'"

This is less than clear, since there are no laws binding the U.S. government to make good on FDIC

insurance liabilities.

The details of FDIC are found on Wikipedia | Source Wikipedia

|