|

| €100 |

| €100 - I bet you wish you could push print. ;-) |

| €10,000 |

| €10,000 - “Madness is badness of spirit, when one seeks profit from all sources” - Aristotle |

| €1 Million |

| €1,000,000 - Not as big of a pile as you thought, huh? "Bankers own the earth. Take it away from them, but leave them the power to create money and control credit, and with a flick of a pen they will create enough to buy it back." -Sir Josiah Stamp, former President, Bank of England |

| €100 Million |

| €100,000,000 - Approximately the size of the bonuses that CEO's of big banks got during the financial crisis. "Whoever controls the volume of money in any country is absolute master of all industry and commerce." -James A. Garfield, President of the United States. |

| €2 Billion - A Truck Load Full of Cash |

| €2,000,000,000 -

Cyprus Economy is €19.3 Billion, roughly 10 of these trucks. "History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and it's issuance." -James Madison |

The Cypriot Government Bailout Problem |

The Cypriot Government could not bail out its banks due too high debt-to-GDP ratio & Cyprus' oversize banking sector. The people of Cyprus could not bail out its two failing banks - Bank of Cyprus and Laiki Bank (a.k.a. Popular Bank).

The size of the Cyprus banking system at €150 Billion over-shadows the nation's GDP at €19.3 Billion. Bailing out the banks would put Cyprus in same position as Greece. |

|

||||

|

||||

| Cyprus Economy by the Numbers |

This graphic shows why Cyprus could not bail out its banks. |

|

|||||||

|

|||||||

|

||||||||

|

|||||||

|

||||

|

||||||

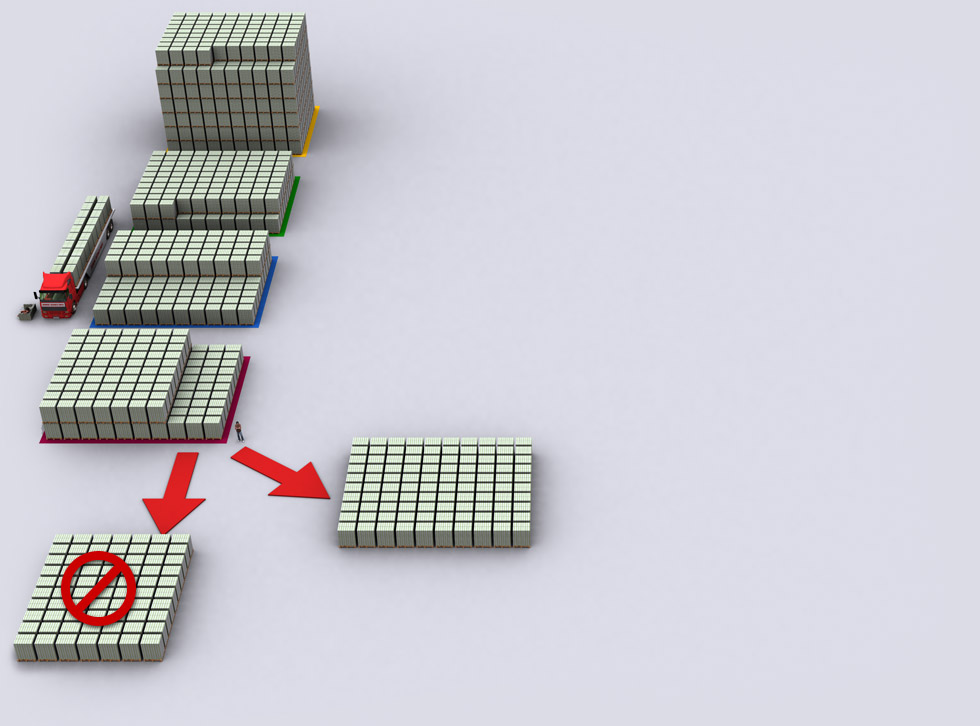

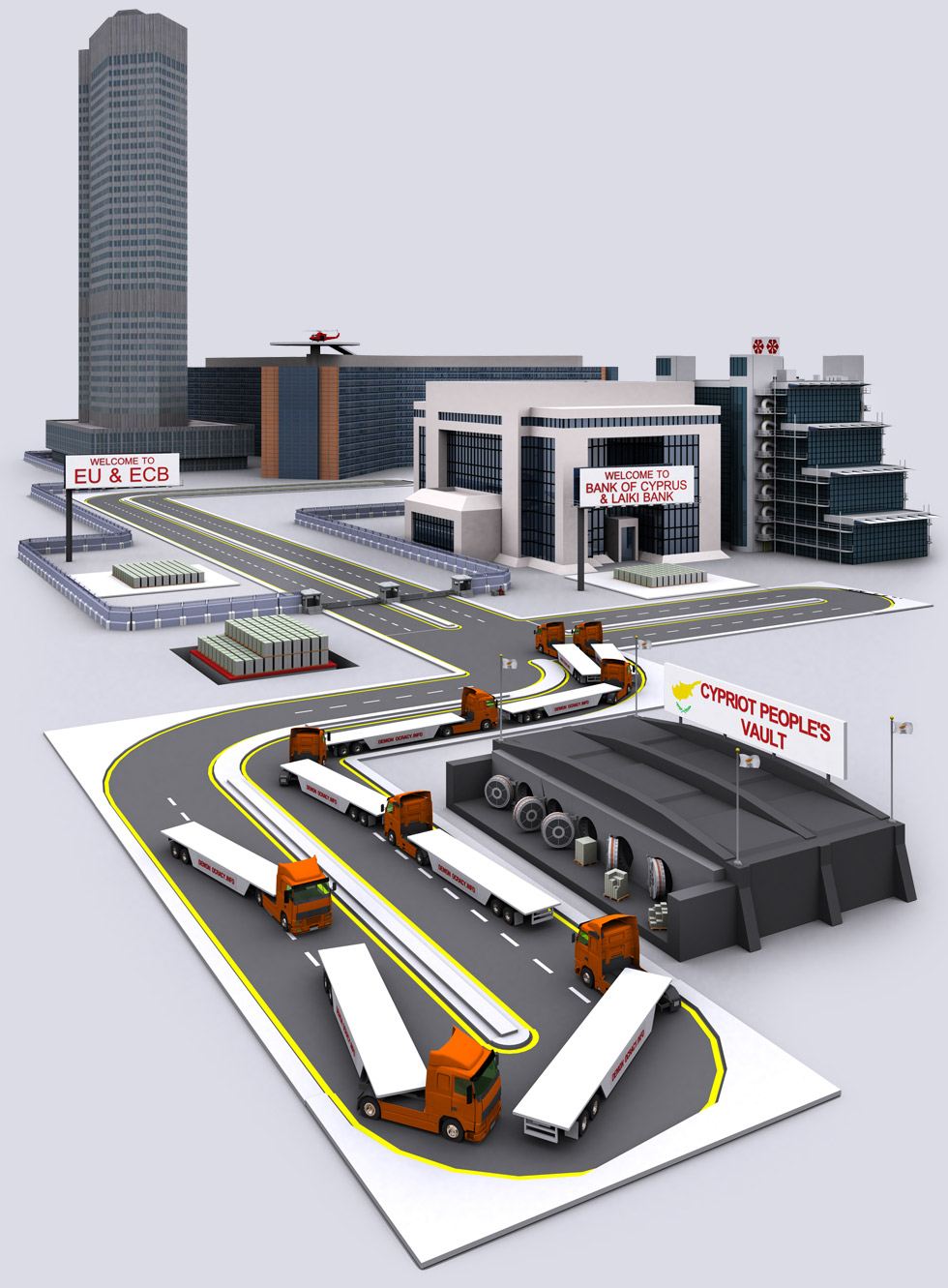

| Cyprus' Failed Financing Needs: The Road to Confiscation |

The banks started to fail once they had to admit to losses, as in forced to write off bad Greek loans. This caused a bank run and capital controls were put in place, violating the foundation of the Euro, that within the currency no capital controls shall be used. Initially Cyprus asked a sum of €17 Billion to bail out its government and banks. The plan by the EU Troika was to put a levy on Cypriot failing banks, which meant everyone must take a loss, including insured depositors, since the ECB wanted the loan to Cyprus government (who would give it to banks as bailout) to be secured. This did not go well since insured deposits are to be protected in accord with modern banking. Instead the Cypriot failing banks got nothing, while the Cyprus Government gets the €10 Billion bailout with harsh consequences. Cyprus is only getting €10 Billion to bail out the Government, where €7.5 Billion of the €10 Billion will go to re-finance maturing bonds held with the ECB, all while the loan is provided by the ECB. This results to the ECB kicking the can down the road, for someone else to deal with in couple years. The financing for the banks has to be found elsewhere (taken from uninsured depositors). The fact EU let the banks fail, along with EU Finance Minister's comments that Cyprus is a template for rest of Europe, has scared depositors elsewhere in Europe. Bank crises from now will likely hit uninsured depositors, who are now looking to move their money into safer locations. This has caused cash outflows from the World's oldest bank, Italy's Monte dei Paschi di Siena (MPS), who is in trouble with 2x bailouts already completed, and Slovenia who is currently denying need for help, even though the math says different.

|

|

|

Berlaymont BuildingEuropean Union HQ |

|

|

|

|||||

|

||||

|

|

||||

|

|

| €68.4B Billion - Cyprus' Bank Deposit Distribution - By Nationality |

Cyprus bankrupt Banks have (had) a lot of wealthy Russian and British customers. Once the banks closed due to insolvency, the branches of Cyprus' bankrupt banks were left open in Britain and Russia, enabling its foreign customers to withdraw money while Cypriots could not. Many of the people that will get wiped out by the crisis will be ordinary people who had savings over €100,000 and small Cypriot business' who find themselves with zero cash. An unofficial reason for EU to oppose bailing out Cyprus banks was the large Russian cash hoard at Cyprus banks, and bailing out the banks would also bail out rich Russians with German money. As the Cyprus economy spirals down, Cyprus will likely need another bailout. |

|

||||

|

€20.9 BillionForeign Deposits outside Euro zone |

|

|

|

|||||

|

||||

|

||||||

|

|

| €42.8 BillionCypriot Deposits | |

|

|

|

|

| Who Let the Dogs Out?Someone left the foreign branches of Cyprus Banks open in Russia and UK while Cypriot Banks were on lock-down. A lot of wealthy foreign clients were able to withdraw a lot of money outside Cyprus. |

|

|

|

| €68.4 Billion - Cyprus' Bank Deposit Distribution (& Losses) - By Amount |

The big depositors will get hit harder than expected, because a lot of money left the banks right before the banks went into lock-down. |

|

||||

|

Insured Deposits

Under €20,000 €18.5 Billion |

|

|

|

|||||

|

||||

|

||||||

|

||||

|

|

| Escaping MoneyA lot of money escaped through branches of Cypriot Banks in Russia and UK that stayed open. A lot of money escaped through elite Cypriots, including the current Cyprus President transferring millions out of the banks days before crisis started. Here's a list of people with insider knowledge, who withdrew € millions from the banks before they collapsed. |

|

|

|

|

||||||

| More Infographics |

|

|

|

|

|

|

|