Federal Reserve's Money Printing Failure |

The Federal Reserve is the Central Bank of United States of America. It is responsible for printing the U.S. dollars & much more. |

One Hundred Dollars |

| $100 - Most counterfeited money denomination in the world. Keeps the world moving. |

Ten Thousand Dollars |

| $10,000 - Enough for a great vacation or to buy a used car. Approximately one year of work for the average human on earth. |

One Million Dollars |

| $1,000,000 - Not as big of a pile as you thought, huh? Still, this is 92 years of work for the average human on earth. |

| One Hundred Million Dollars |

| $100,000,000 - Plenty to go around for everyone. Fits nicely on an ISO / Military standard sized pallet. The couch is made from $46.7 million of crispy $100 bills. |

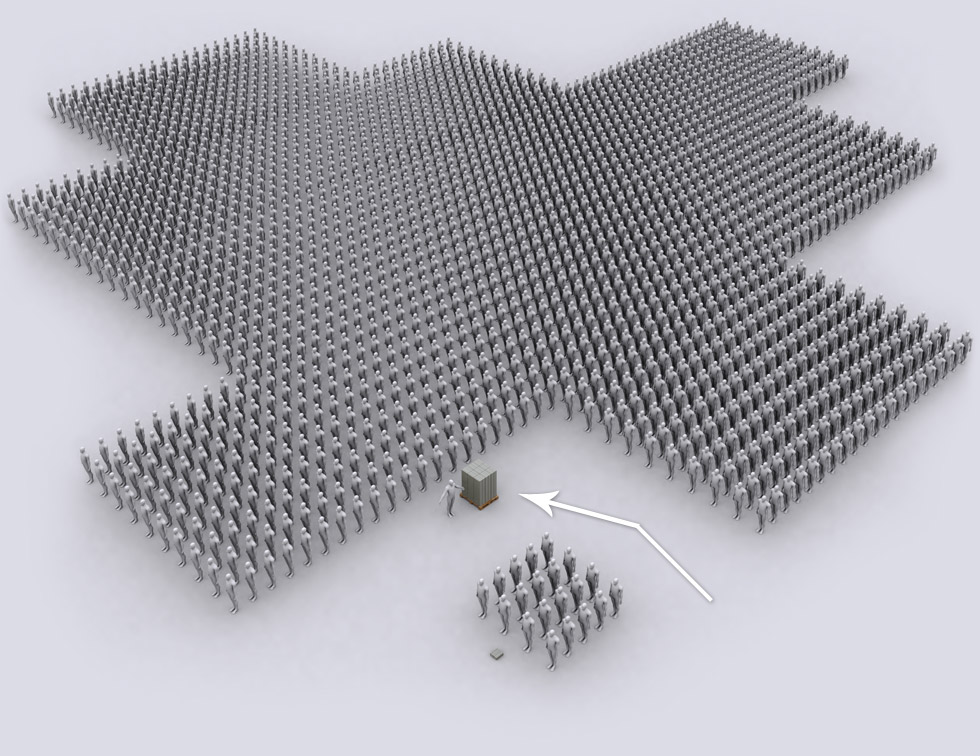

$100 Million Dollars provides 2000 jobs @ $50,000 / year |

Here are 2000 people standing shoulder to shoulder, looking for a job. |

|

| One Billion Dollars |

| $1,000,000,000 - You will need some help when robbing the bank. Interesting fact: $1 million dollars weighs 10kg exactly. You are looking at 10 tons of money on those pallets. |

The Federal Reserve - Central Bank of United States of America |

The Federal Reserve has a bottomless pit of money at its disposal. It is arguably the most powerful institution in the world- it controls the money of the Reserve Currency of the World - The US Dollar. It could destroy the world economy by simply changing the main interest rate (Federal Funds Rate), just like in '07/'08. How money printing happens: The newly printed money is just a number on the computer; printing real money is expensive. The Federal Reserve must have a system to spread the newly printed money. It spreads the money by 'taking over' existing loans; in essence buying the loans (from banks, hedge funds or other financial institutions). This system reimburses the banks the money banks loaned out before it's repaid by client, by so injecting new money into the economy. Little known fact: All money is debt. All money is loaned into existence. Banks create (90%+ of all) money by making a "Reserve Requirement" deposit with the Federal Reserve. If a bank deposits $1 million with Federal Reserve, with a 10% Reserve Requirement it can loan out $10 million by simply typing it into the computer into an account. This is called Fractional Reserve Banking. Federal Reserve also works as a lender of last resort when the banks that loaned out 10x more than they have deposited, get a 'run on the bank' and can't come up with the money-- when more people are pulling it out than they have available. Federal Reserve protects the system that allows lending out what one does not actually have. Federal Reserve is also a private bank, privately owned and not responsible to the Government, or anyone, except possibly its 300 private share holders. |

You are looking at little over $13 Billion dollars getting ready to be transported out, into the economy. Each pallet of $100 million dollars weighs exactly 1 ton (minus the pallet). The trucks shown carry 20 tons of cash. Legal carry weight is usually between 22-25 tons.

|

|

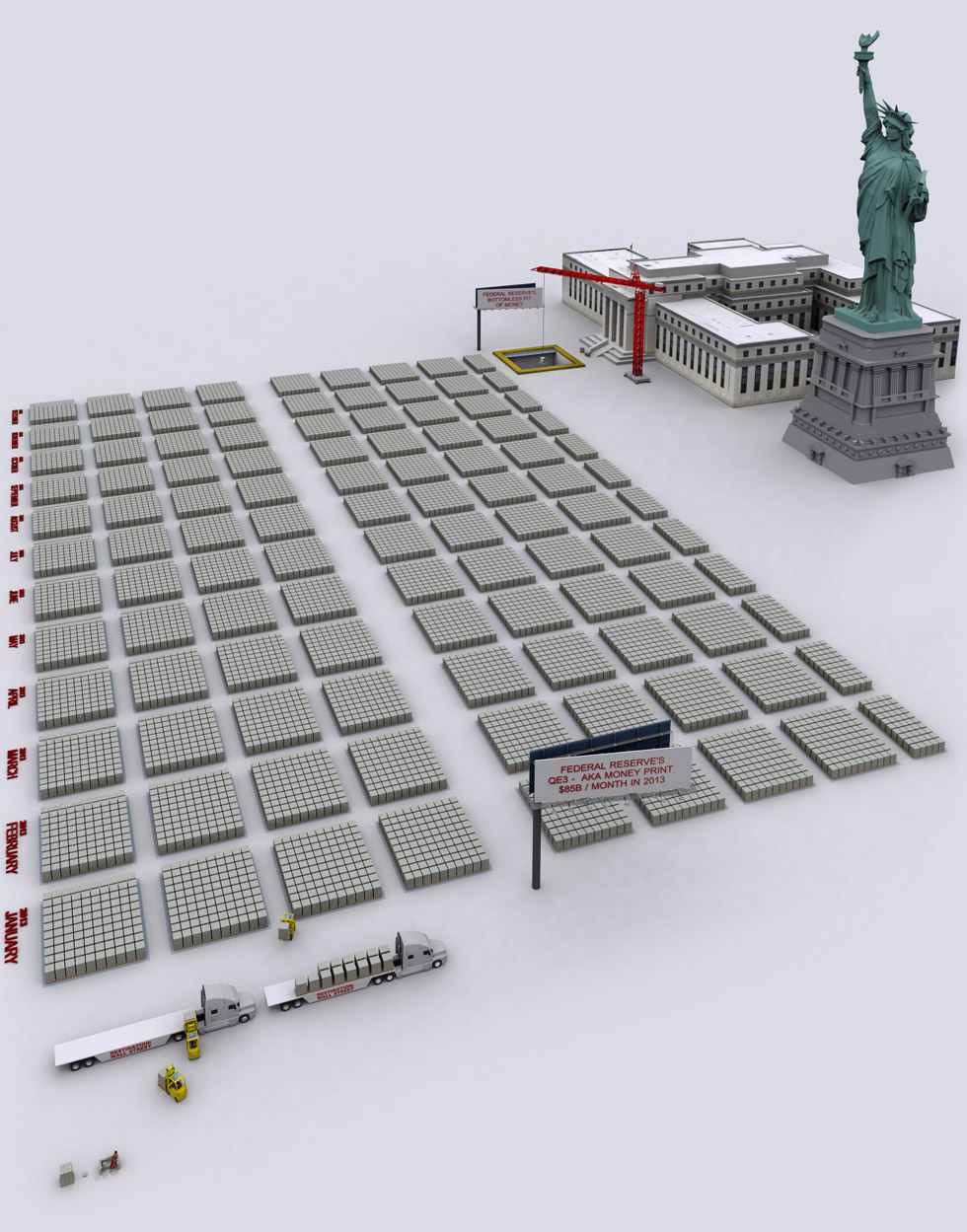

Quantitive Easing 3 (QE3) - Fancy name for cash printing operation |

| Federal Reserve to print $40 billion a month for remainder of 2012. $40 billion a month would amount to 9,600,000 jobs paying $50,000 / year. Unfortunately, more money does not equal more jobs. The newly printed money is not getting loaned out to consumers (as intended by the stimulus package) but stays with the banks and the banks invest the newly printed money in stocks for fast profits, by so pushing the stock market higher. The money does not go to SBA Bonds that are aimed at pumping cash into small business sectors. |

| Quantitive Easing 3 (QE3) continues into 2013 $85 Billion / month in 2013 |

Above is the projected Federal Reserve printing volume of dollars for 2013. This is equivalent to 20.4 million jobs per year paying $50,000 / year.

|

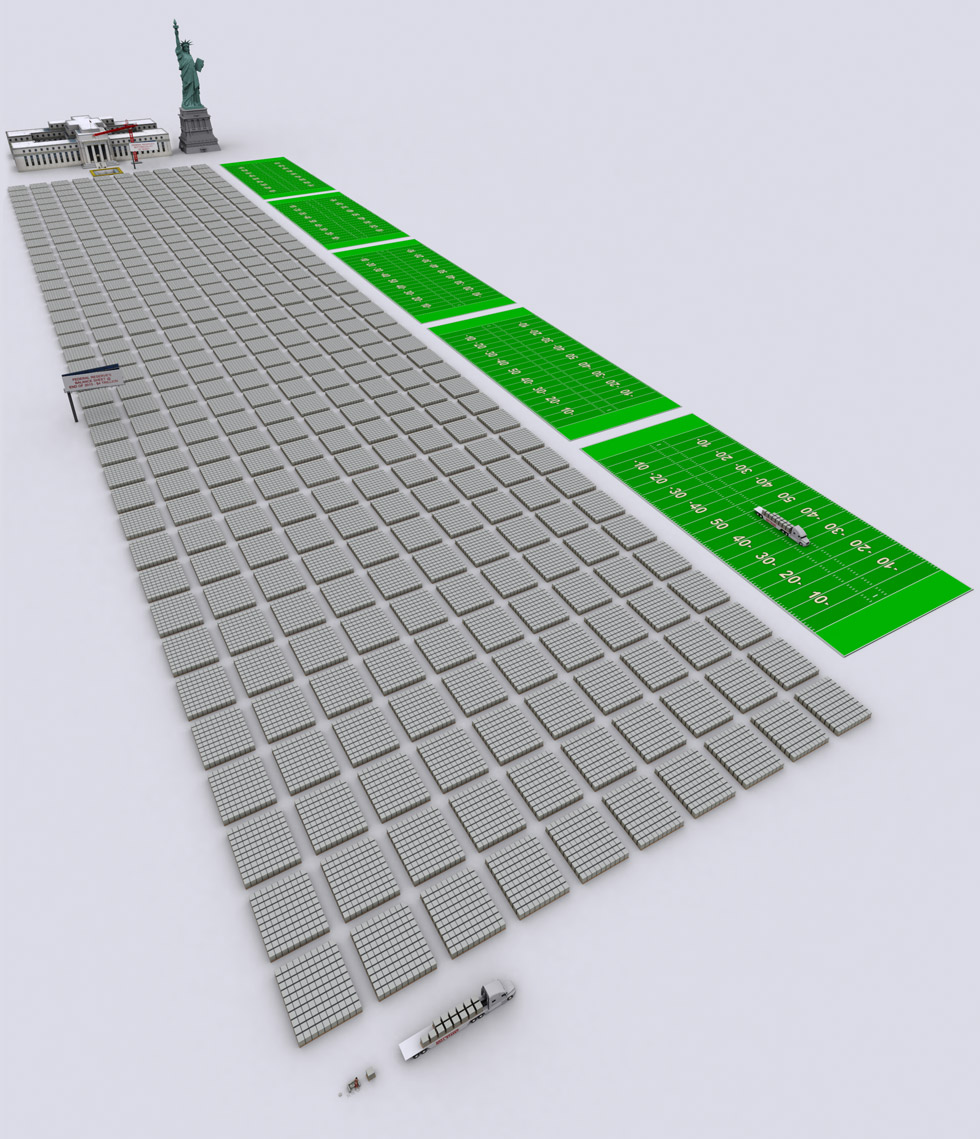

| Federal Reserve's Balance Sheet by End of 2013: 4,000,000,000,000 - $4 Trillion |

||||

As explained above, the Federal Reserve's Balance Sheet is the amount of assets The Fed has purchased (removed) from the free market in order to stimulate it. The Fed owns as of 2012-10-06, 27.2% of the bond market.

|

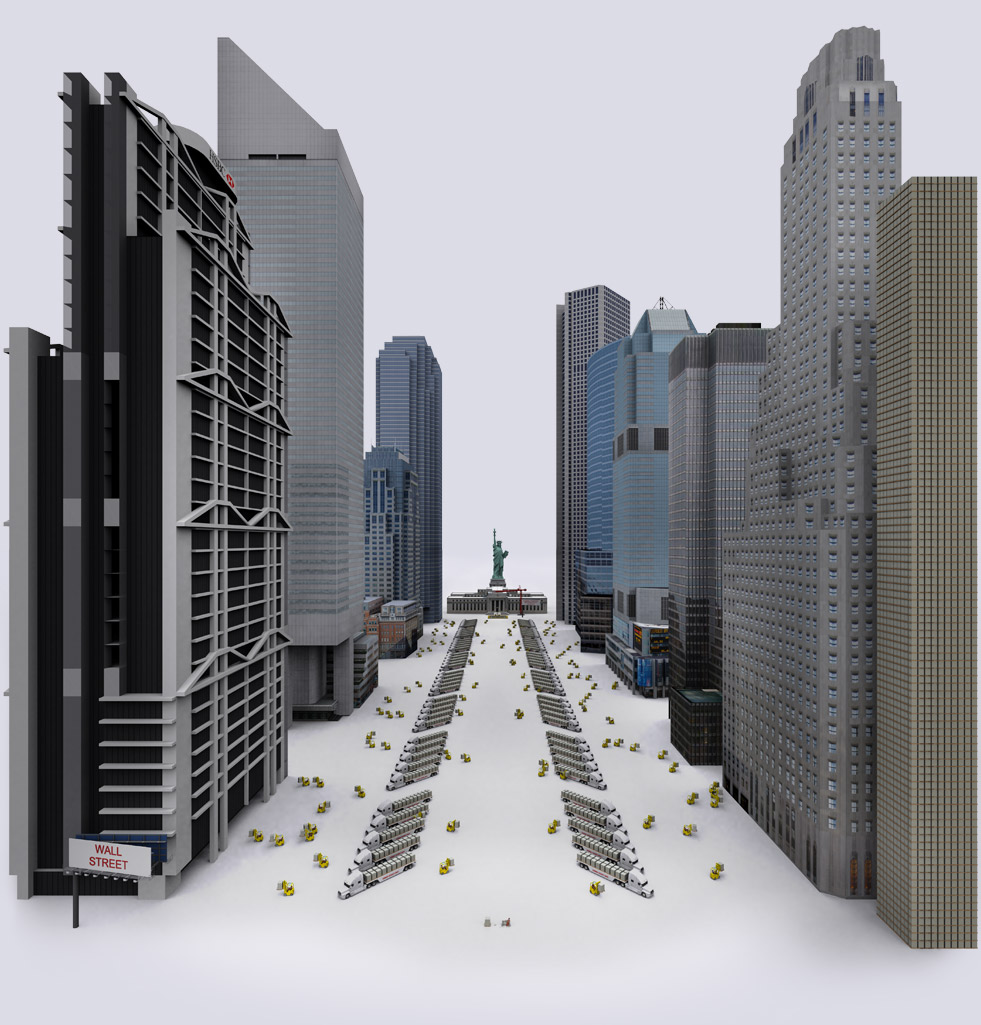

| Occupy Wall Street, this time by trucks loaded with cash |

Welcome to Wall Street, the capital of the free market. It is full of semi trucks today. The 2013's stimulus package (QE3) of $1020 Billion Dollars has been nicely stacked on the far right side, awaiting 2013. Each economic boost through money printing (QE1, QE2, QE3) has diminishing effects, that appear to follow the Fibonacci equation. This implies that the Federal Reserve is now caught in a perpetual cycle where it has to print near exponentially more money just to maintain same stock market performance level, not mentioning inflation. . Verdict: Truck drivers and fork-lift operators on Wall Street have good job security as QE4 is now a certainty. |

| Welcome to Wall Street |

This is where Federal Reserve's newly printed money ends up.

|

| More Infographics |

|

|

|

|