Budget Talks & Fiscal Cliff - Explained - Cheat Sheet |

UPDATE: As of Jan 1st, 2013 the Fiscal Cliff was eliminated by passing American Taxpayer Relief Act of 2012. |

| $100 Dollars |

| $100 - Most counterfeited money denomination in the world. Keeps the world moving. |

| $10,000 Dollars |

| $10,000 - Enough for a great vacation or to buy a used car. Approximately one year of work for the average human on earth. |

| $1 Million Dollars |

| $1,000,000 - Not as big of a pile as you thought, huh? Still, this is 92 years of work for the average human on earth. |

| $100 Million Dollars |

| $100,000,000 - Plenty to go around for everyone. Fits nicely on an ISO / Military standard sized pallet. The couch is made from $46.7 million of crispy $100 bills. |

| $100 Million Dollars provides 2000 jobs @ $50,000 / year |

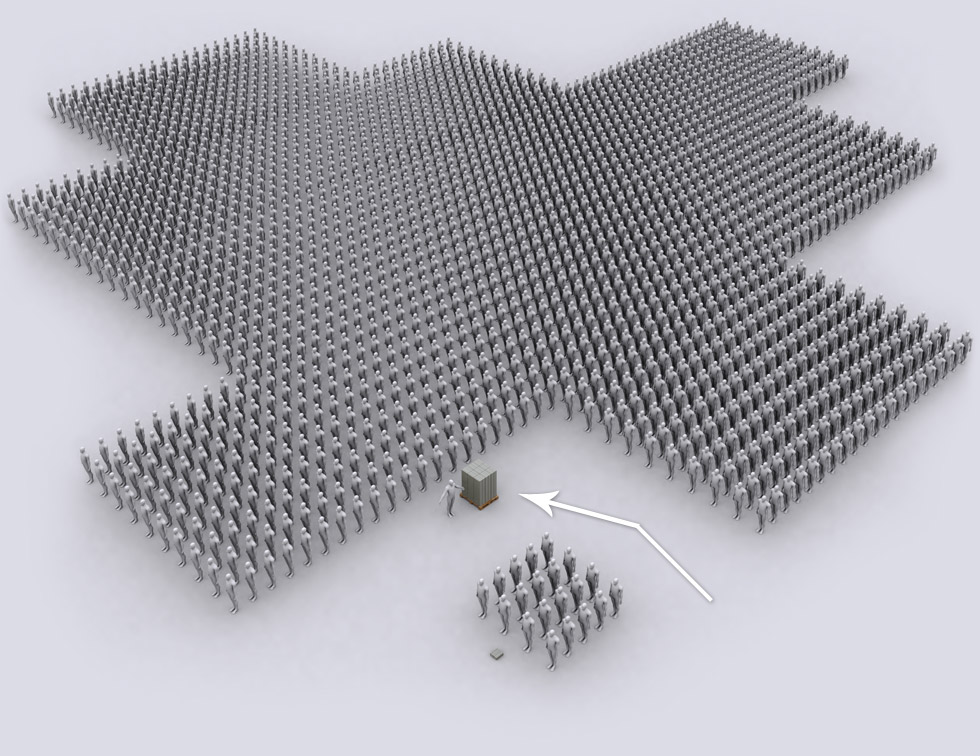

Here are 2000 people standing shoulder to shoulder, looking for a job. |

|

| $1 Billion Dollars |

| $1,000,000,000 - You will need some help when robbing the bank. Interesting fact: $1 million dollars weighs 10kg exactly. You are looking at 10 tons of money on those pallets. |

| 2013 US Government Budget scenarios: Jan 1, 2013 budget agreement ATRA 2012 (current) bill vs the Fiscal Cliff |

| Budget w/ ATRA 2012 |

| Budget w/ Fiscal Cliff |

A new years 'Fiscal Cliff deal' named "American Taxpayer Relief Act of 2012" (ATRA 2012) was made in Congress, in the 11th hour on Jan 1st, 2013. |

|

The new 'Fiscal Cliff deal' dubbed ATRA 2012 makes Bush's Tax cuts permanent for individuals earning less than $400,000/year, for those over it, rates are raised back to 39.6% as it was during Clinton's era. The automatic budget cuts (sequestration) that were agreed during the Debt Ceiling debate of 2011 have been delayed for two months. Obama's temp 2011 Pay-roll tax cuts expired as well, which means $50 less take-home per month for an American earning $30,000/year. The 'Fiscal Year'- used for US Government accounting purposes starts in October, 3 months early of actual calendar year. US Government's 1st Fiscal Quarter of 2013 (Govt's accounting years start & end in October) finished with a $122 Billion per month public debt growth, which will come out far over a $1 Trillion in 1 year. The US Government also surpassed the Debt Ceiling of 16.394 Trillion on Jan 1st, 2013, and will now continue by ravaging pension & other funds to borrow money from, until Debt Ceiling is lifted once again. The graphic is based on US Government's FY2012 budget of $3796 Billion and CBO's projected Fiscal Cliff' scenario's

+19.63% increase in revenue and |

|

|

||||

|

||||

|

||||

|

||||

|

||||

|

||||

|

||||

|

||||

|

||||

|

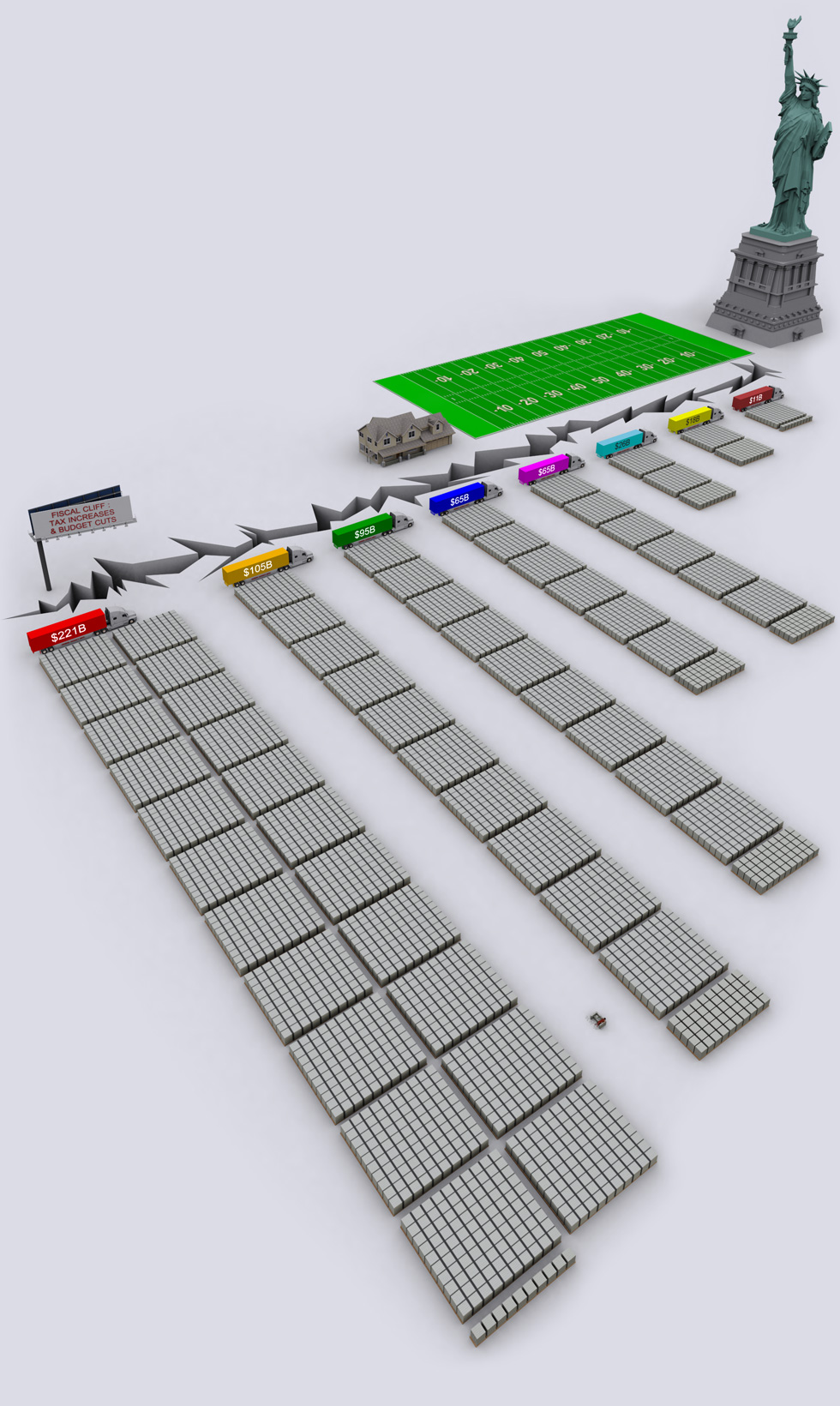

| Original Fiscal Cliff was an increase in taxes & reduction in Govt' spending | ||||||||||||||||||||

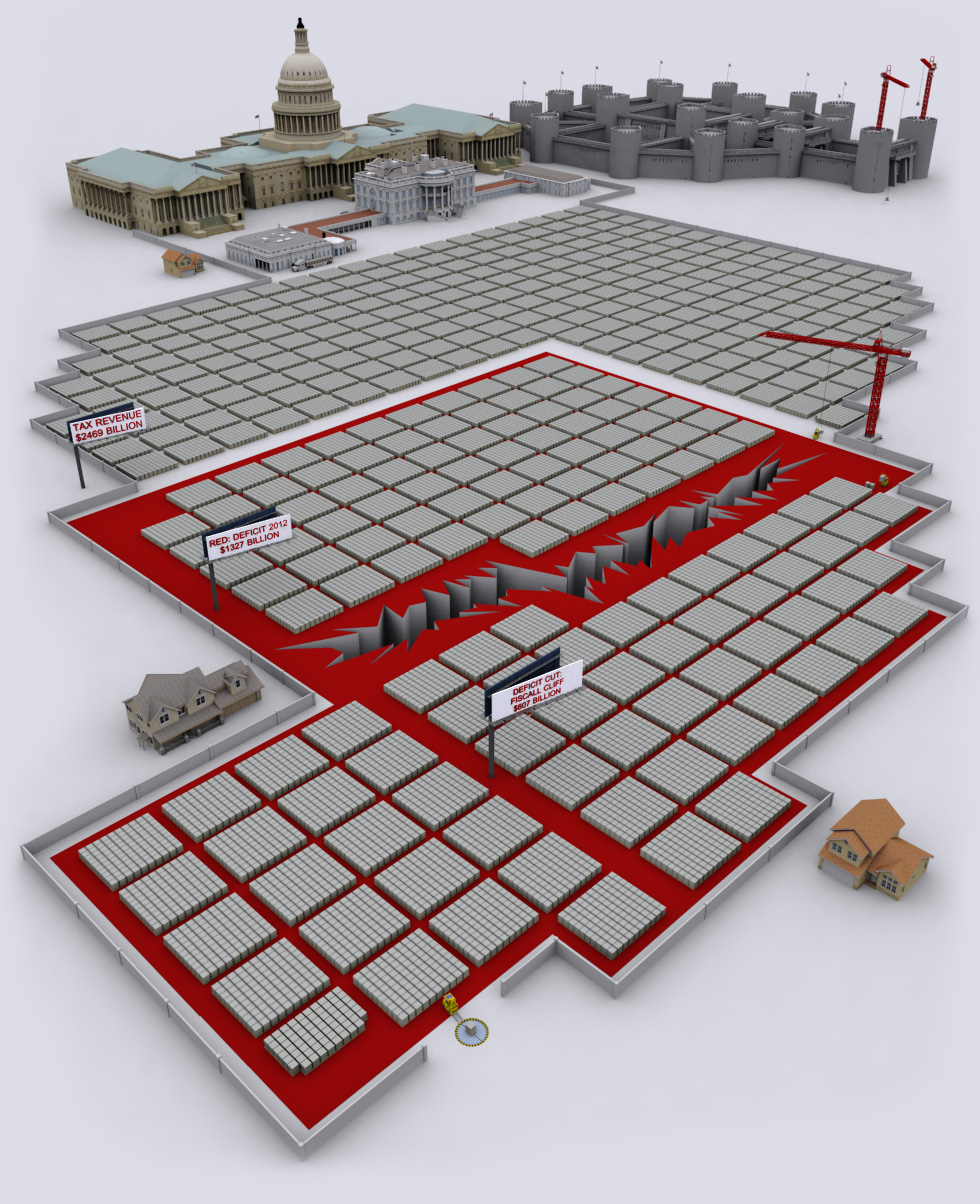

In 2012, the US Government expenses were at 153% of tax revenue. |

||||||||||||||||||||

|

||||||||||||||||||||

Original 2012 Fiscal Cliff Plan: |

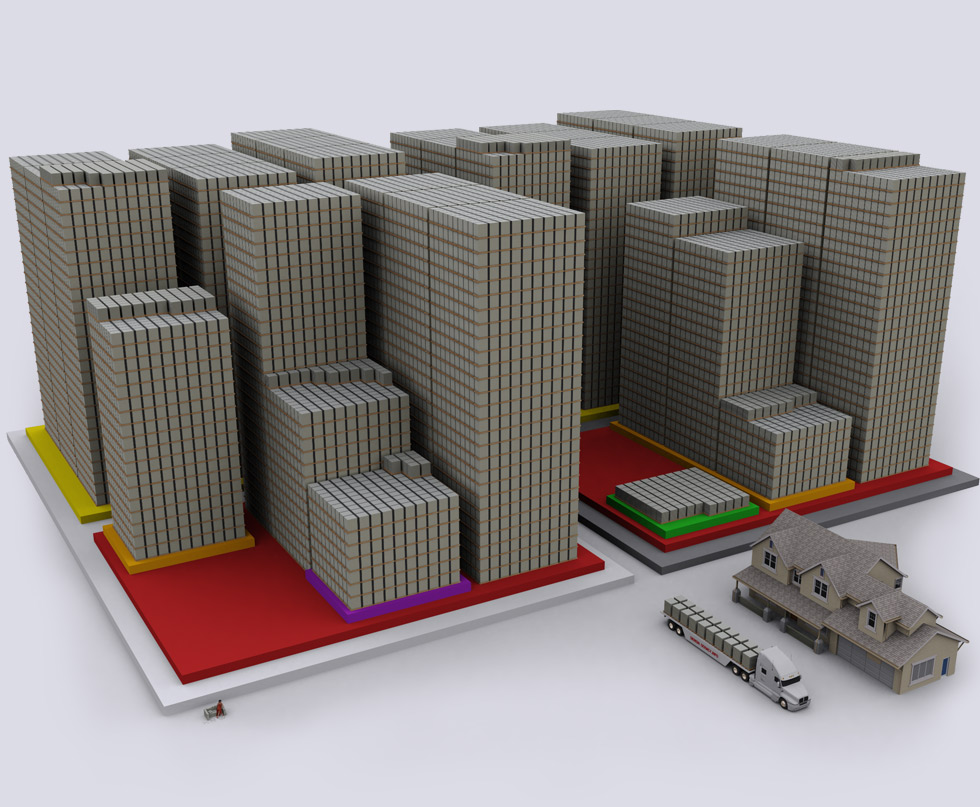

Beginning 2013, Americans are to pay more in taxes. Each truck holds $2 Billion, each line is 1.36 miles (7217 feet), for a total truck line length of 2.73 miles, worth $400 Billion. |

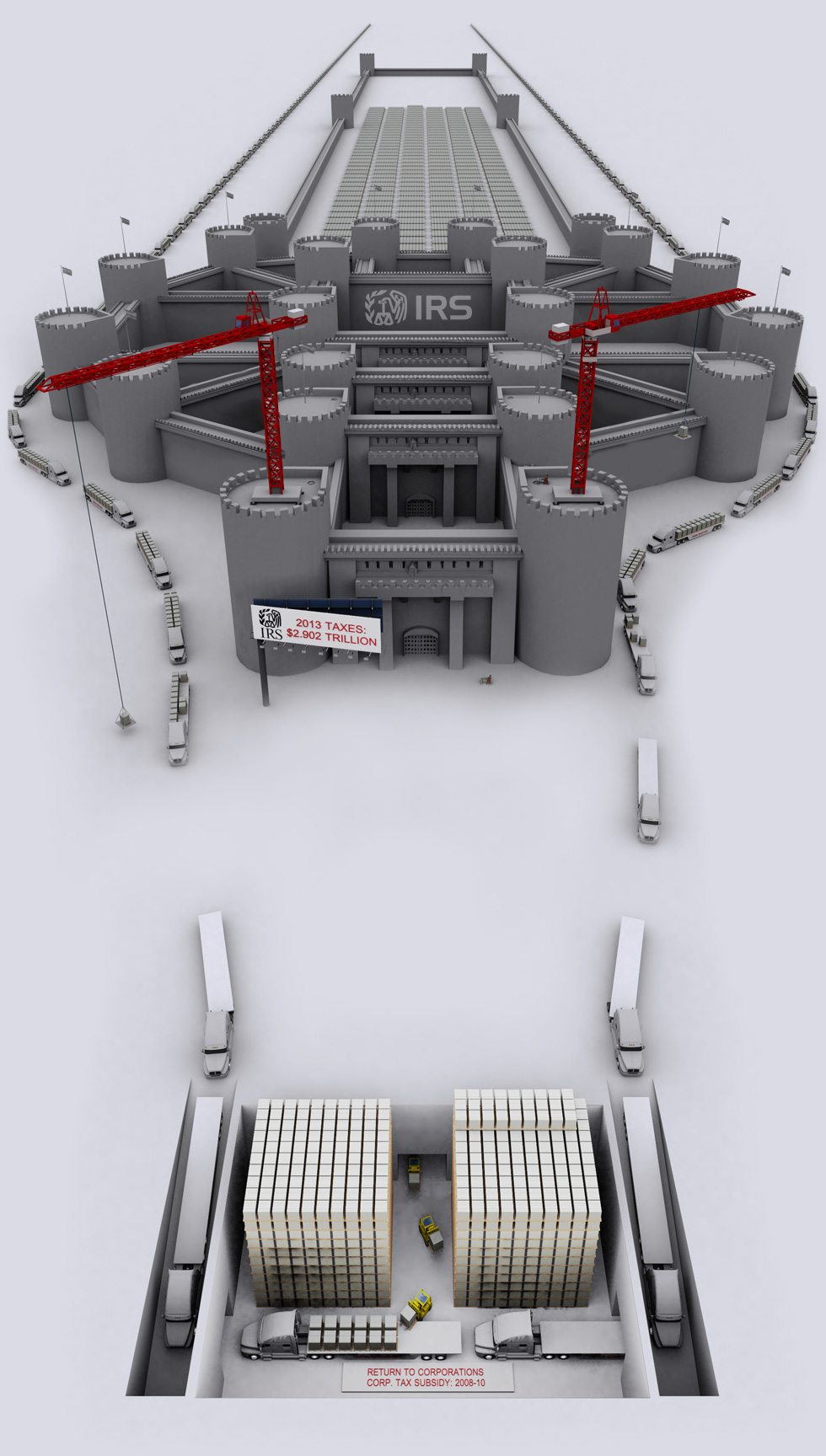

$222.7 Billion Bonus: Corporate Tax Subsidies |

While the taxes are increasing significantly on American citizens, the largest corporations have enjoyed corporate tax loop-holes. |

|

|

|

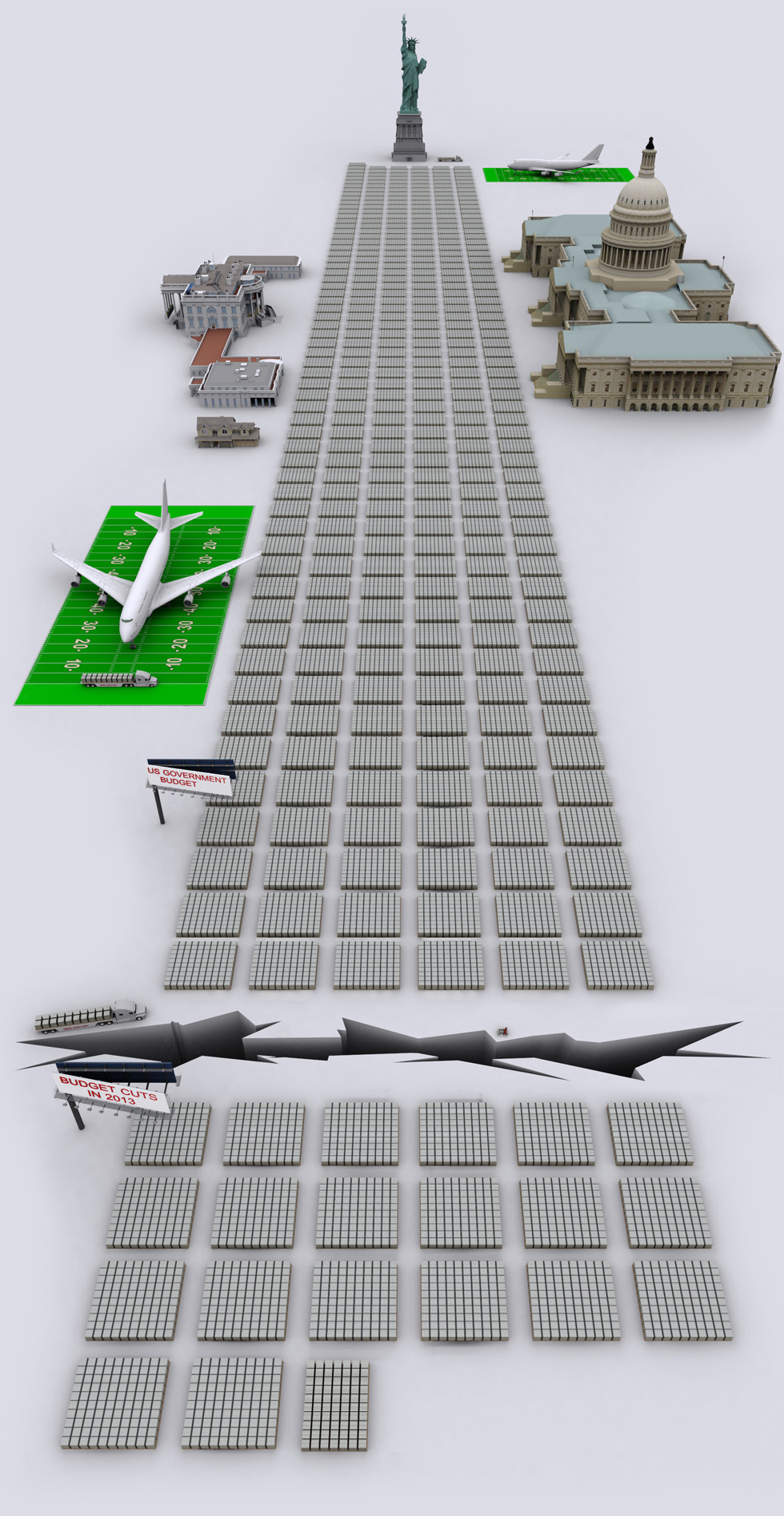

| Original 2012 Fiscal Cliff Plan: Part 2 of 2: Budget Cuts |

The Fiscal Cliff will cut $207 Billion out of Government budget: $26 Billion in cuts will come from the Unemployment Benefit Extension expiring. $11 Billion in cuts will come from reduction in Medicare Payment Rates. $105 Billion will come from other spending reductions. Full list here

|

|

|||||||||||||

| Original 2012 Fiscal Cliff's Deficit Reduction Effect |

The Fiscal Cliff exists because the US Government must cut down the deficit spending.

The Fiscal Cliff will crack $607 Billion off from US Government budget deficit, erasing approximately half the deficit. The Politicians want to avoid the Fiscal Cliff because it will put the economy in recession, and they don't want to cut funding to their favorite Government (friends) branches-(defense, health care, education, etc).

If the Fiscal Cliff is "avoided", then the issue is simply pushed down the road, for another day. |

| Original 2012 Fiscal Cliff's Deficit Reduction |

|

||||

|

|

||||

|

||||

| More Infographics |

|

|

|

|

|

|

|