The $10+ Trillion 2020 Economic Stimulus by the Federal Reserve

| One Hundred Dollars |

| $100 - Most counterfeited money denomination in the world. Keeps the world moving. |

| Ten Thousand Dollars |

| $10,000 - Enough for a great vacation or to buy a used car. Approximately one year of work for the average human on earth. |

| One Million Dollars |

| $1,000,000 - Not as big of a pile as you thought, huh? Still, this is 92 years of work for the average human on earth. |

| One Hundred Million Dollars |

| $100,000,000 - Plenty to go around for everyone. Fits nicely on an ISO / Military standard sized pallet. The couch is made from $46.7 million of crispy $100 bills. |

| $100 Million Dollars = 1 year of work for 3500 average Americans |

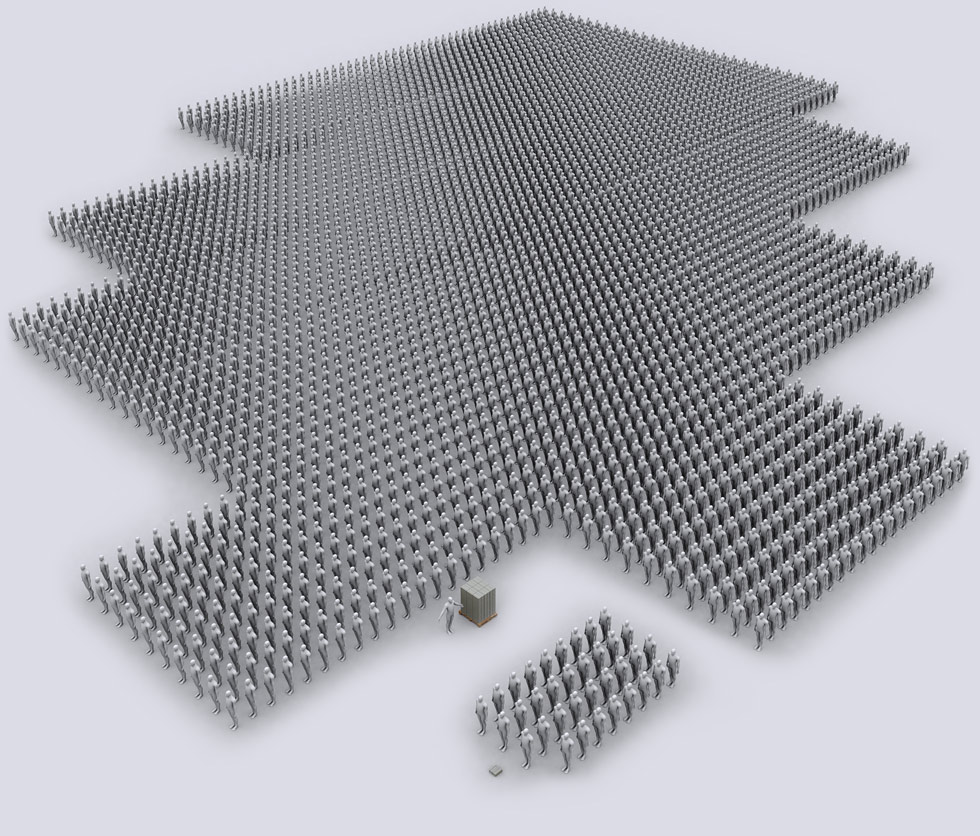

| Here are 2000 people standing shoulder to shoulder, looking for a job. The Federal Reserve's mandate is to maintain price stability and low unemployment. The Federal Reserve prints money based on the assumption that increasing money supply will boost jobs. |

| One Billion Dollars |

| $1,000,000,000 - You will need some help when robbing the bank. Interesting fact: $1 million dollars weighs 10kg exactly. You are looking at 10 tons of money on those pallets. |

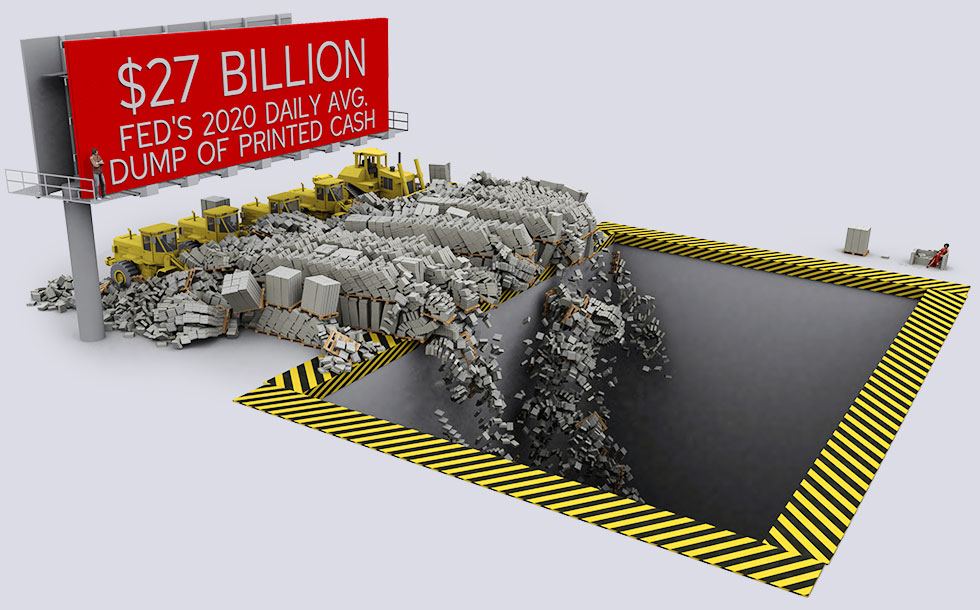

| $27 Billion Average Printed per Day in 2020 |

The Fed & US Government has committed to print $10.5+ Trillion in 2020 through various stimulus programs to offset the global economic standstill caused by the virus quarantine. |

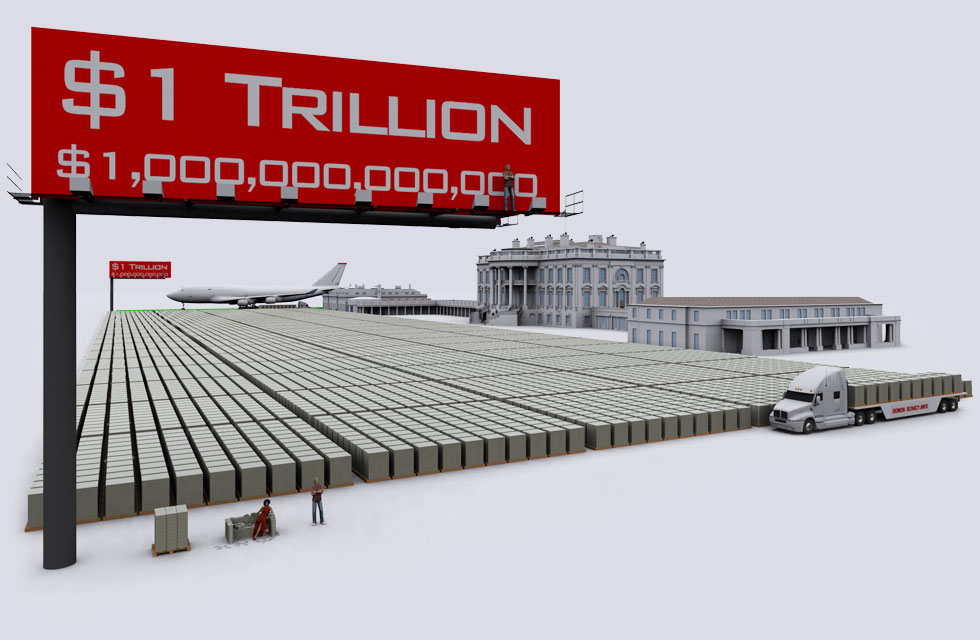

| One Trillion Dollars |

| $1,000,000,000,000 If you spent $1 million a day since Jesus was born, you would have not spent $1 trillion by now... |

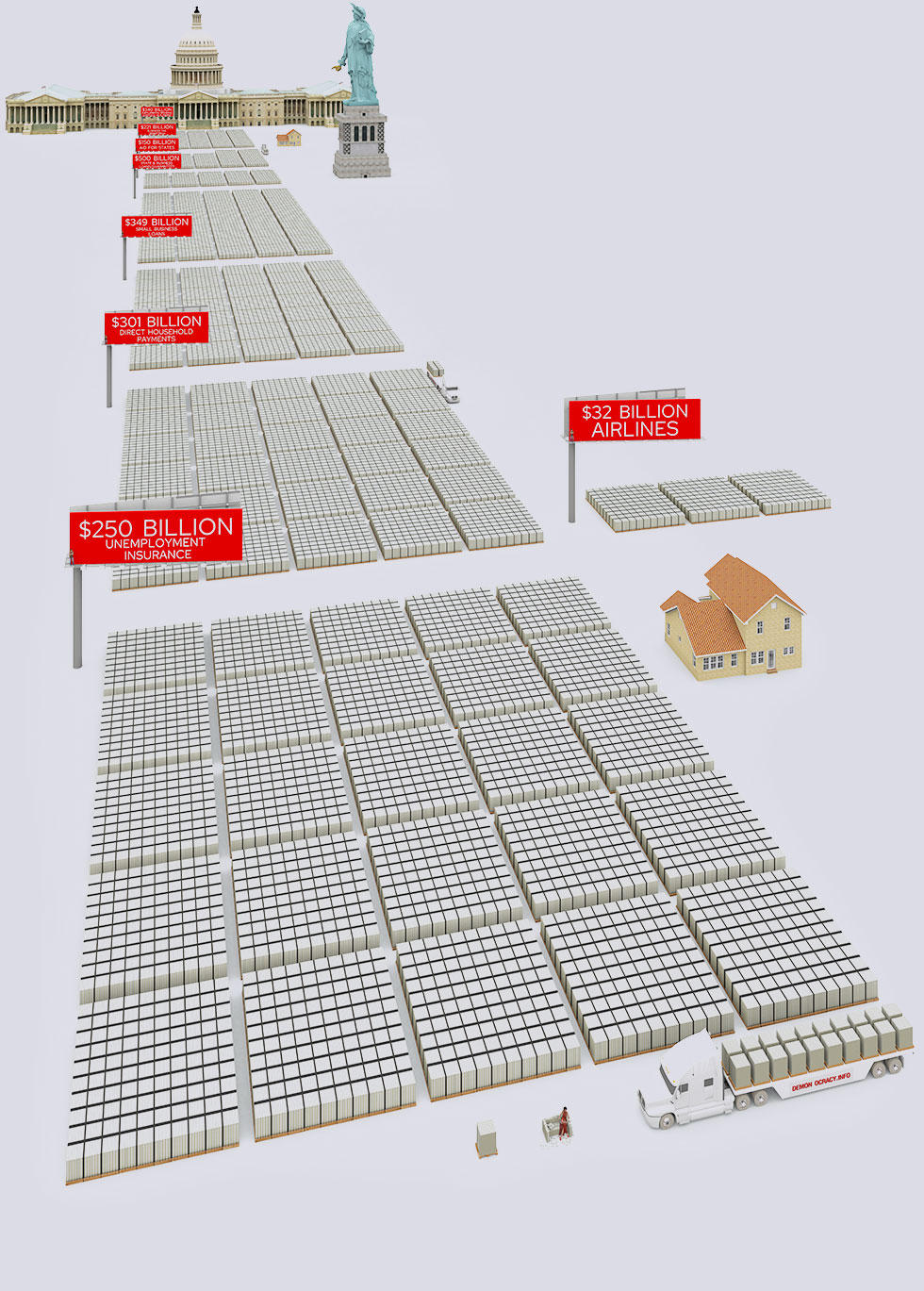

| 2020 $2 Trillion Emergency Stimulus Package by US Government |

In response to the virus quarantine lockdown causing the US (and world) economy to stop, the US government has put together the biggest stimulus package in American history, in order to help corporations and people escape effects of quarantine.

The $301 Billion for direct payment to households (also known as UBI or helicopter money, is only ~15% of the entire rescue package. Also, this rescue package is just one of many. The vast majority of the package goes to bail out corporations, many of whom have done stock buy-backs in recent years and now do not have the cash on hand needed to weather the financial standstill.

|

Fly-through of the scope of $2 Trillion US Government Emergency Economic Stimulus Bill

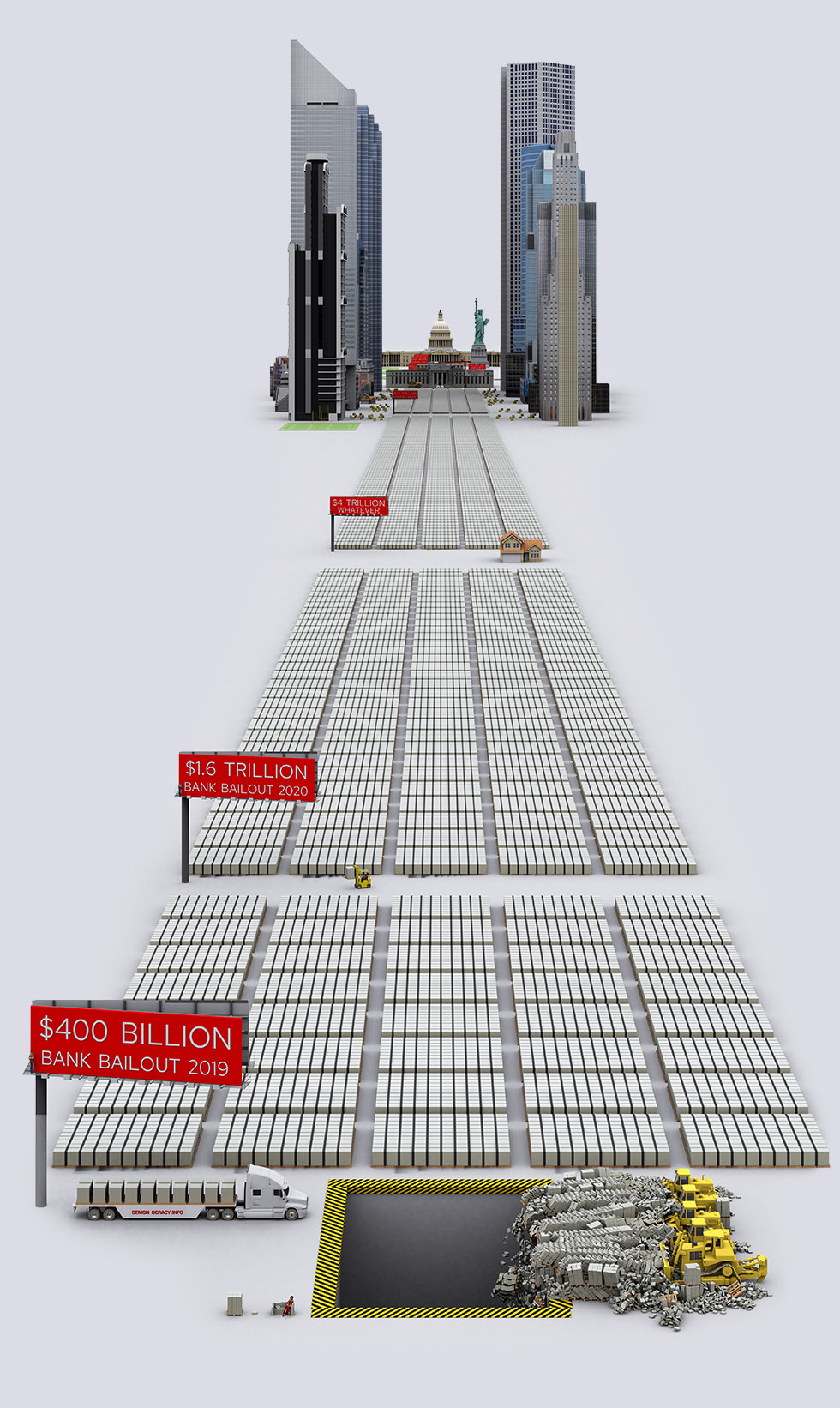

| 2020 $10+ Trillion Federal Reserve Stimulus Package | |||||||

What's going on and what happened? There are currently 6 major economic stimulus packages (money printing operations) running as of May 2020. Seen to the right is a list & timeline. The most famous stimulus package is the 2020 $2 Trillion US Government Bailout of the Economy, but this is just a small piece of the giant money printing puzzle. The 2009-2020 economic cycle has been the longest economic expansion in history. The expansion was fueled by historically low interest rates and Fed money printing stimulus (QE), where Fed in co-op w/ banks increased the money supply by giving loans that were not backed by real savings, this requires continuous credit injection into the financial system. Since the 2008 crash, the underlying economy has never expanded with the stock market. Stocks, real estate and investment prices climbed ever higher. The banking system was already experiencing crisis events in September 2019, with Federal Reserve injecting $412 Billion into banks, so banks can make it through Christmas/NY 2020 and then continued injecting money in 2020. Fed at first pretended this liquidity injection is not QE money printing, which was pushing stocks to new all time highs. In 2019, before the virus lockdown started, a market legend predicted the 2020 stock crash. The virus lock-down was the catalyst, not the cause, which provided a good cover for all policy makers and politicians to blame the current global economic debt reset crisis on the virus. Truth is that the Fed was already injecting vast amounts of money into the economy before the virus crisis started, and the virus is only a catalyst and excuse, while the global economic debt reset crisis has been brewing for decades. Not many noticed this financial crisis development before the virus lock-down.

|

|

Bailout List & Timeline:2019-09-10-2019-12-31 $400+ Billion Bank Bailout 2019 "Liquidity infusion" to keep banks from collapsing through New Year 2020.

$1.6 Trillion Bank Bailout 2020 QE so big it dwarfs the 2008 financial crisis, and it's only April 2020, even Fed head trader admits it's unparalleled.

$4 Trillion Fed Bailout of "Whatever" The Federal Reserve pledged to provide $4 Trillion in "whatever" stimulus in 2020 because of the virus, then changed it to "open ended quantitative easing", which means in simple terms "print as much money as needed" to avert deflation and prevent the financial system from collapsing. $4T is just a number on "whatever it takes".

$2 Trillion Bailout Largest rescue package in American history when passed by into law.

$2.3 Trillion Federal Reserve bailout for the US Economy, for "Main Street". Working people will get $500 billion while Wall Street and Corporate America will get 3 times that amount ($1.7 trillion).

$484 Billion Corona Virus Funding Bill Who even cares or can keep up with the $Billions thrown left and right? We did not add this to the graphic, we have re-rendered the graphics so many times because The Fed is releasing new stimulus and printing faster than we can update the graphics. What's $484 billion at this point? No one even notices.

|

|||||

|

||||

| $4T Fed Bailout "Whatever" | |

$400+ Billion Bank Bailout 2019 |

|

Bank buildings: |

|

|

||||

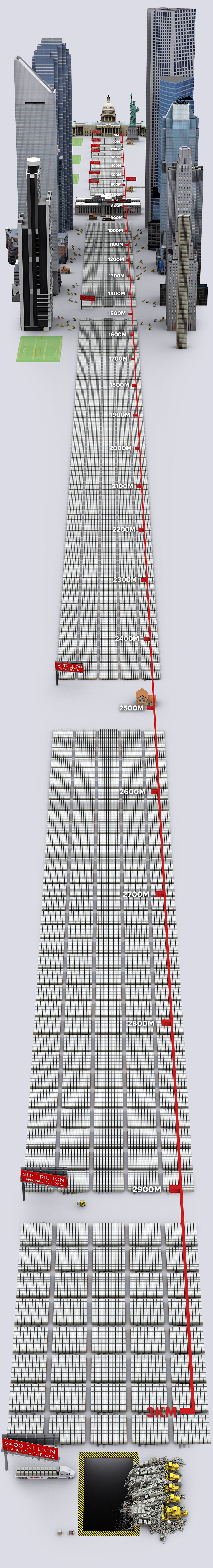

| 2020 $10+ Trillion Hyperinflation Stimulus Package - Perspective View | ||

$10.5 Trillion is over 30% of U.S. GDP and more than twice the U.S. government yearly budget. Question: What is the end game? Why hyperinflation? Because the interest rate is the value of money itself, and is set to zero. Interest rate is the opportunity cost of lending the money- risking not getting money back and deferring current spending power until later. Money is the most capitalistic thing in existence, but paradoxically the value of money is centrally controlled by the central banks of the world; not controlled by the free market. You may not decide what value (interest) money in your bank acct carries; the central banks decide. |

||

The interest rates are now set to ZERO. In many countries. This implies that the value of money is ZERO, meaning there is no risk or deferred opportunity cost when lending out money. Some countries even have NEGATIVE interest rates, something that was considered fringe conspiracy theory just 10 years ago is now the new normal. The USA can't ever go back to normal interest rates. US Debt is at $25+ Trillion as of May 2020. With normal interest rate of 5% the US Government debt service cost would be $1.25 Trillion per year. Tax revenue is at $3.5 Trillion. When one pays 35% of one's yearly revenue to service debt interest, everyone knows one is bankrupt. With 0% interest rates this can go on for much longer. This is one of many reasons for low rates. |

||

| Fed Printing Mechanism |

| The Fed prints money by buying assets off bank's hands, such as mortgage backed securities, government & corporate bonds, etc., by so infusing cash into the banks. The Fed used to buy AAA grade assets during QE 1->4, but now in 2020 Fed is buying junk bonds, stocks, and other trash. To keep stocks and markets up, the Fed is buying everything everyone is selling, even stocks. This is why markets have irrationally gone up since March 14th, 2020 and as of May 2020 stocks are green for the year, despite largest percentage of workforce unemployed since during depths of the Great Depression. Markets are now bought and centrally controlled by the Fed & CB's, just like in USSR. The new strategy for investors is just to buy what the Fed is buying. |

Some people are asking "All this debt and QE money, but where is the inflation?",

that is a valid question. - Central Bank Money (obligations of central banks) When YOU deposit $1000 in cash (central bank money) into a commercial bank, with the current 10% fractional reserve system the bank can lend out $10,000 to a borrower (while holding your $1000 as reserve), creating a total of 9x more cash than deposited.

This $10,000 is commercial bank money.

Free from the obligation, courtesy of the Fed, the The banks buy stocks from people/sellers The factory workers of Porsche and Ferrari |

The trickle-down effect fallacy means that the people that are most likely to immediately spend the money and people that need it the most, will get it last, highly diluted, getting the breadcrumbs, after all other assets in upper-level classes have inflated, completely leaving the lower classes of society out of reach of homes, new cars, stocks, etc. The rich get richer and the poor get poorer with help of the Federal Reserve: The ultimate creator of inequality in the world. We suggest you research "the truth behind the central banking system" for yourself. The government statisticians love reporting fake inflation numbers, by creative ways of modifying the Consumer Price Index, repeatedly removing very important factors from the statistics that would otherwise reveal CPI going up. Statisticians love to emphasize inherently strongly-deflationary goods such as electronics as one of main factors when calculating inflation. The lower class is getting screwed from all directions: fake trickle-down effect lies, while the government covers their money printer's back with fake inflation numbers. |

| Deflation's Role |

First deflation, then hyperinflation. That is the argued road forward for the global world economy. With the world indebted as never before, the biggest fear for the financial system is deflation. Deflation occurs when velocity of money slows severely. During deflation things become

cheaper and

people hold off buying as tomorrow prices

will be lower, and even lower next month. While waiting

for lower prices, the economy grinds to a halt.

While stocks, real

estate and other investments go down in price, the debt

burden remains the same, eating away the world's money at the same

rate

every month, while there's less cash to go around. Deflation creates a bad downward spiral for fractional reserve banks. The assets they hold lose value and risk making banks and other investment systems insolvent and bankrupt. |

To stop deflation in 2020 due to virus lockdown, the Fed will inject trillions (and it is not alone) into the economy. With 'whatever it takes' approach of "open-ended QE" the Fed will likely flood the system with enough money to stop deflation, but deflation will reverse and become hyperinflation all due to vast amounts of newly printed money. Fed chief Jerome Powell said that the Fed is “not going to run out of ammunition” on the money printer. . The Fed does not exactly know what is "enough" in stimulus amounts, because the effects are only seen months/years later. Evidence of over-printing cash can be seen with stocks doing the impossible, where as of May 13th, 2020, NASDAQ is green for 2020 and had the first 6 days of >1% gains since Sept 2000, all during a global virus lock-down. |

| While stocks pump because of money printing, much of economic activity is historically created by issuing debt/credit, the marginal utility of debt is collapsing. This means that ever more debt is required to create the same increase in economic activity. Consumers and creditors are loaded up on credit/debt and meeting diminishing returns. Hyperinflation for assets for Wall Street finance while main street economy collapses. |

| With global lock-down, eventually borrowers will start defaulting, which will cause interest rates to rocket as risk goes up. The $1+ quadrillion derivatives market is interest related and also will also come crashing. |

| The End Game: Future uncertainty will avert consumption, creating a deflation spiral. The Fed will pump cash into the system until people will start to expect higher prices, which will push people to spend money today, instead of tomorow. That is when hyperinflation comes, from all the newly printed money that has been printed. When there's talk that Central Banks need to raise rates (in order to reel in all the printed money), we will be close to a Weimar hyperinflation style end game. |

It is safe to say that most folks have no idea about implications regarding the $ trillions the Fed prints, numbers that are so big they are incomprehensible for the average man. The Fed can print $1 Trillion or $100 Trillion, it all looks the same. We're on our way to a hyperinflationary

depression end game. |

Since you have lost meaning of money by now, this |

|

The Fed will continue printing, creating even more inequality. Analysts predict that the Fed will need to cut 1% on rates and go into negative interest rates or print another $3.3 Trillion, not pictured here in these graphics.

|

|

||||

Fly-through of the scope of $10+ Trillion Federal Reserve & US Gov Economic Stimulus Bill, Visualized in in Physical Cash

| More Infographics |

|

|

|

|